by Zenia Henderson, Director of Member & Partner Engagement, National College Access Network

by Zenia Henderson, Director of Member & Partner Engagement, National College Access Network

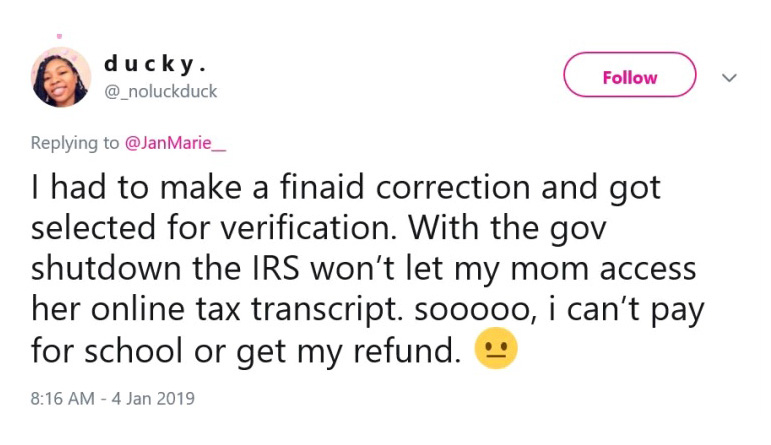

We know the tweet pictured here sounds painfully familiar to you and your students, given the current limited access to critical FAFSA-related IRS services. Don’t panic and hang tight! Repeat this statement to your students (and to yourself). We expect relief with some of these issues over the next seven calendar days.

For more information about the disruption of certain key IRS services, read this article from the Washington Post and this piece from MarketWatch.

Here’s what we expect to happen over the next few days and what we recommend to our members.

| The Problem | Expected Resolution | NCAN Recommendation |

| The tax transcript ordering services on the IRS website are unavailable. | The Department of Education (ED) released an Electronic Announcement permitting copies of tax returns and written statements of non-filing as acceptable documentation for verification purposes for both the 2018-19 and 2019-20 application cycles.

Additionally, the tax transcript service is expected to become available on Jan. 14. |

We recommend you make your students, families, and community/school partners aware of these changes and help students work with their institutions accordingly.

If for any reason a tax transcript needs to be ordered, we recommend waiting until Monday, Jan. 14. |

| The partial government shutdown is causing issues for the processing of 2018-19 and 2019-20 FASFAs that require the Selective Service database match. It is possible- and currently unclear- if other database matches are being affected through agencies such as the Department of Homeland Security and the Department of Justice. | According to NASFAA, the Department of Education (ED) is aware of the issue. ED reported to NASFAA that “at the first opportunity after restoration of the database match, which won’t be until after the shutdown ends, ED plans to reprocess all affected Institutional Student Information Records (ISIRs).” | We recommend you guide students to work directly with their institutions should verification of selective service become an issue. According to NASFAA, schools can refer to the FSA Handbook for guidance, which “permits financial aid administrators to visit the Selective Service System web page to check a student’s status by entering the necessary identifying information.” |

| There will be a temporary IRS Data Retrieval Tool (DRT) outage this weekend. | The IRS DRT will be down on Saturday, Jan. 12 from 6 a.m. to noon ET for scheduled maintenance,according to FSA. | We recommend students not submit a FAFSA during this time to ensure they can access the DRT. There are no other announced outages and DRT should be functioning properly otherwise. |

Earlier today, on Jan. 9, the office of Federal Student Aid (FSA) released guidance to provide some relief to students struggling with FAFSA verification.

What does this mean for your students?

- Institutions can now accept tax returns (not just tax transcripts) to verify income, saving students time and hassle.

- If students are unable to obtain verification of nonfiling from the IRS, institutions can accept a signed statement.