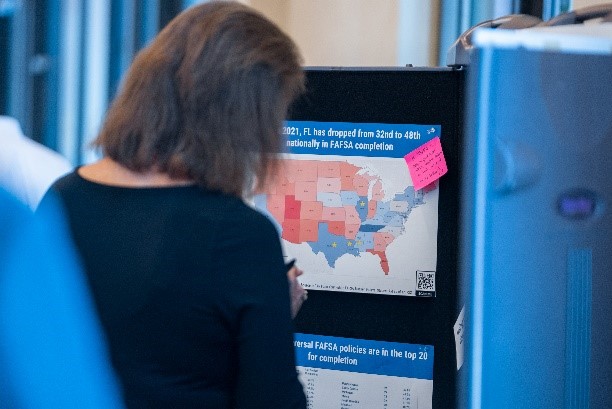

This year, Florida saw a precipitous drop in its FAFSA completion numbers. Where Florida was 32nd nationally at the end of our FAFSA Challenge in 2021, this year, FL sat at 48th. Although many other states have seen drops in completion during the pandemic, this drop felt different for Florida.

This year, Florida saw a precipitous drop in its FAFSA completion numbers. Where Florida was 32nd nationally at the end of our FAFSA Challenge in 2021, this year, FL sat at 48th. Although many other states have seen drops in completion during the pandemic, this drop felt different for Florida.

Fewer FAFSA completions likely mean fewer students considering attending college, as FAFSA can unlock aid for students attending a variety of postsecondary institutions, including technical colleges and career programs. While financial aid varies from school to school, and not all colleges and career schools participate in the federal student aid programs, FAFSA can help open doors to many types of aid, including federal aid, state aid, institutional aid, grants, scholarships, loans, and work-study jobs. Unfortunately, these numbers are already playing out: college undergraduate enrollment dropped 4% in Florida this spring compared to last year, and is down nearly 50,000 students compared to spring 2020.

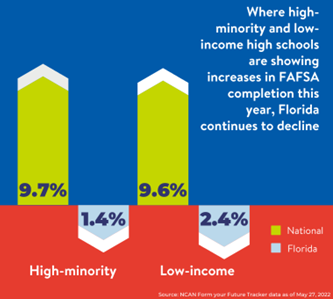

While these numbers are in line with national drops, why did Florida see such a massive decline in FAFSA completions, especially when most Florida students returned to in-person learning in 2021? It is concerning to see our peer states show a different story (Louisiana, Texas, and Alabama are in the top 10 for completion). We have at least some idea: unlike national trends, which are showing an increase in completion for low-income and high-minority schools, Florida is experiencing the opposite. FAFSA completions in low-income and high-minority high schools continue to decline, amidst even larger declines from the year before.

While these numbers are in line with national drops, why did Florida see such a massive decline in FAFSA completions, especially when most Florida students returned to in-person learning in 2021? It is concerning to see our peer states show a different story (Louisiana, Texas, and Alabama are in the top 10 for completion). We have at least some idea: unlike national trends, which are showing an increase in completion for low-income and high-minority schools, Florida is experiencing the opposite. FAFSA completions in low-income and high-minority high schools continue to decline, amidst even larger declines from the year before.

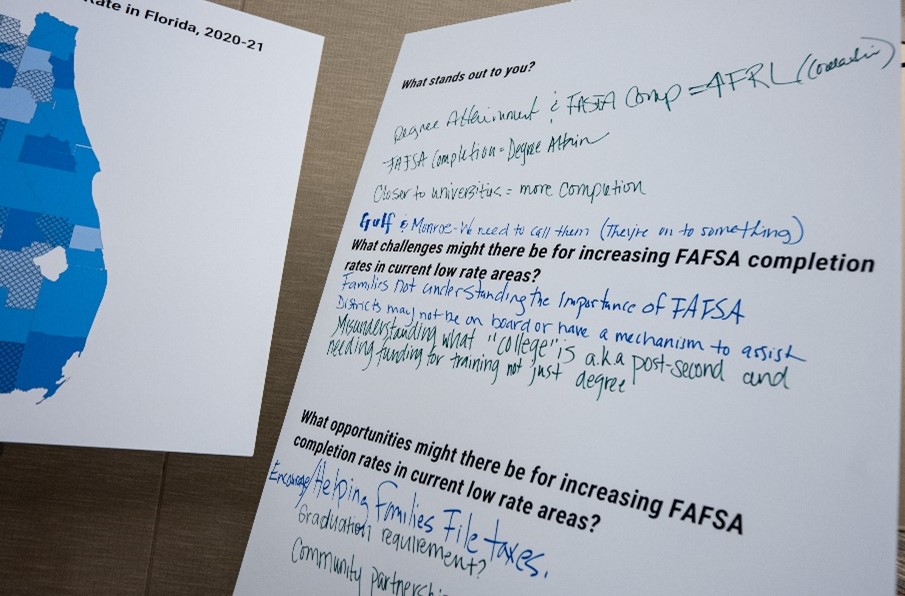

The FCAN team has been having conversations with our partners about these numbers and, at our annual summit on May 10-11, held an interactive data presentation and a participatory workshop to get ideas for what is happening and how we can tackle this drop.

From those conversations, we wanted to share some of our findings:

Filling out the FAFSA remains difficult

Although FAFSA simplification is coming (on schedule to be fully implemented by the 2024-25 award year) and some changes are in place, the FAFSA is still a complicated and daunting task. Our partners, many of whom mentor students or work in K-12 or higher education, shared that the application is “not intuitive,” “frustrating,” and “students give up easily.” Students’ potential financial aid packages are not clear on the form, and students often need someone sitting with them working through the form together, which requires a lot of time and labor.

The FAFSA also requires information from parents, and if parents are not easily available or are reluctant or unable to provide information, students may run into a dead end and give up.

We hope that the form itself will get better with simplification, although all of these changes may also contribute to confusion from mixed messaging and constant change. For example, the IRS data retrieval tool will be automatic, so students do not have to reenter tax information, and hopefully reassure parents who may resist entering their information due to fears of sharing information with the government.

In short, it is hard to continue educating our students and families about the constant updates to FAFSA when it is already an intimidating process. This may affect how we think about messaging the importance of FAFSA. It also speaks to how essential guidance counselors, education staff, and community volunteers are when it comes to having trust with parents and sitting down with students to go through the form.

To help make the FAFSA less daunting, FCAN launched the Cash for College campaign last year, which seeks to connect directly with students and their families while providing the resources they need to get started filling out the form.

There are systemic barriers to FAFSA completion

Many of our workshop participants shared why students may not even try to fill out the FAFSA:

- The form requires a social security number and undocumented students, who are not eligible for federal financial aid, cannot complete the form. Note: DACA students with SSNs and some other eligible non-citizens can complete the form. Additionally, parent citizenship status does not affect eligibility for aid. However, this means thousands of Florida seniors cannot fill out the FAFSA, and others may erroneously think they cannot fill out the form if their parents are not citizens.

- The FAFSA requires parental assistance and this is an issue for plenty of students. If students do not have access to their parents, their parents do not have access to the needed information, or their parents are reluctant to share information, students are left at a standstill.

- There are not enough school counselors to help students with the FAFSA form, let alone talk about college-going plans regularly throughout their high school careers. The current Florida student-to-school counselor ratio is nearly 500-to-1, although the American School Counselor Association National Model recommends a ratio of 250-to-1.

- Students think they won’t qualify for aid (even students from low-income households) and choose not to apply.

Many students are overwhelmed by other senior year requirements, unsure of their paths after high school, and do not want to go into debt, and all of these anxieties add to the confusion around the FAFSA and postsecondary pathways in general.

Many students are overwhelmed by other senior year requirements, unsure of their paths after high school, and do not want to go into debt, and all of these anxieties add to the confusion around the FAFSA and postsecondary pathways in general.- With a booming labor market, students are taking jobs directly out of high school instead of choosing higher education. However, if or when the job market slows down, a lack of training or education after high school may hurt students in the long run or during a downturn. Research shows that people with degrees and certifications earn more and have more job stability.

What’s going on in other top-completing states?

Universal FAFSA

A few states have sought to increase FASFA completion rates by making FAFSA completion a requirement for high school graduation. Louisiana was the first state to implement this prerequisite in the 2017-18 school year. So far, the policy has proven to have a substantially positive impact on completion — the state saw a 25% jump in completion in one year and has consistently ranked in the top 3 states for completion since the policy passed. The state also saw the gap in completed applications between high- and low-income school districts close entirely in two years.

Importantly, Louisiana drastically increased the number of FAFSA completion workshops hosted by the Louisiana Office of Student Financial Assistance at high schools across the state (over 200 in 2018-19). The state also supplied training and support to district staff. Students can choose to submit an opt-out waiver, which is easy but requires submission through a school counselor, which can prompt a discussion about going to and paying for college.

At least four additional states recently implemented the Louisiana policy. So far, the states that have already implemented the new requirements – Texas, Illinois, and Alabama in 2021 – are currently sitting in the Top 10 for completion. Alabama and Texas saw a 30% increase compared to their completions the year before.

Access to state financial aid for undocumented students

Access to state financial aid for undocumented students

Although Florida allows certain undocumented students living in Florida in-state tuition (they must apply for an out-of-state fee waiver), undocumented students do not qualify for state aid in Florida (including Bright Futures and National Merit). However, some other states, including states with some of the largest undocumented populations, extend state financial aid for eligible undocumented students. If Florida had something similar, this may not affect our FAFSA numbers, but may clear up some misconceptions about aid.

For example, Texas provides certain undocumented students with access to state financial aid, grants, and loans by filling out the Texas Application for State Financial Aid (TASFA). When Texas recently passed their universal FAFSA requirement, state and local organizations provided numerous summer trainings for school counselors so they had support, including specific training for intricate situations like TASFA. Other regional organizations have ramped up services so counselors were prepared to work with all students, including undocumented populations.

Promising practices Florida can expand

Our workshop participants shared promising approaches and activities they have seen be effective in getting students to complete the FAFSA:

- Peer to peer influencers can meet students where they are

- Because many students still do not know what FAFSA is, why it is useful, or how to complete it — even when schools and counselors spend lots of time and energy on advertising FAFSA — there is a messaging issue about FAFSA and its importance. Yet who is delivering the message matters. Many of our partners said that one of the best avenues to connect with students is through peers — who may look like them — sharing their stories and helping students along their journey. For example, BRACE Cadets in Broward County consistently help students complete their FAFSA as well as have broader conversations about postsecondary success. And PLANit Sarasota engaged six local students to tell messages about FAFSA in their own words on their Instagram and TikTok accounts, garnering over 10,000 views.

- Use paid social media blasts and offer incentives to boost FAFSA Completion

- While the Florida FAFSA Challenge provides a space for friendly competition, many schools and districts shared their success with small paid incentives, like Amazon gift cards or entry into a raffle for prizes like iPads.

- Paid social media campaigns can also be promising and cost-effective. When FCAN ran paid Instagram, TikTok, and Snapchat posts in 2021 in targeted communities, we saw some small completion boosts in areas where the ads ran.

- Tiered supports can help reach all students

- A best practice nationally, structured tiered supports can work as a proactive, all-school way to disseminate large amounts of information, while offering space for one-on-one meetings. At Riverside High School in Duval County, information is disseminated to large groups through parent nights, summer fests, Saturday morning information sessions, activities, emails, and on the school website. Then, counselors filter down to smaller group presentations and workshops in classrooms that create space for students to ask questions and learn information in a more intimate session. Finally, counselors work in smaller groups and provide individual assistance for FAFSA (among other college and career pursuits).

- Build FAFSA into the curriculum or school day

- Connecting with students during the school day (lunch, study hall, or even during class) can offer a more relaxed time to demystify the college-going process. This can also help equip students with knowledge about college-going and FAFSA to reduce fear and break down misconceptions, especially around first-generation students. For example, in some districts in Texas, schools have trained all Government/Economics teachers to teach students about FAFSA and provide time to fill out the form. In Tennessee, some districts allow college and career readiness professionals to help with FAFSA and college applications in English classes.

- Local efforts and shared ownership can help spread out the work

- Partnering with local colleges and universities to provide help from financial aid officers, as well as undergraduate and graduate volunteers, can be a way to take the burden off school counselors, while giving students broader knowledge about college options. Students also can benefit from hearing about FAFSA in community spaces like churches, the YMCA, and the Boys and Girls’ Club, to help the message sink in.

Takeaways

Florida recognizes the value of a degreed workforce. However, we currently have unequal degree attainment rates, and this means Florida is losing out on $53.6 billion annually in earnings. When we see that Florida uniquely is seeing declines in FAFSA completion from high-minority and low-income school districts, we are at risk of exacerbating inequity in our state, and losing our standing in Florida’s goal to be in the top 10 largest economies in the world. We are also missing out on sustaining a trained talent pool ready to work and give back to your communities.

Florida recognizes the value of a degreed workforce. However, we currently have unequal degree attainment rates, and this means Florida is losing out on $53.6 billion annually in earnings. When we see that Florida uniquely is seeing declines in FAFSA completion from high-minority and low-income school districts, we are at risk of exacerbating inequity in our state, and losing our standing in Florida’s goal to be in the top 10 largest economies in the world. We are also missing out on sustaining a trained talent pool ready to work and give back to your communities.

Among all of the feedback from our partners, overall, we have a messaging issue. Students hear both that college is expensive, but that it is also affordable in Florida. They hear that the FAFSA is really hard, but it is now easy. They may know they can get an excellent job with a career certificate, but also hear they are better off with more education. They are told to apply early before the money is gone, but then later see that their county has thousands of dollars left on the table because students did not apply for aid. Among these conflicting messages, students likely feel confused and even wary of the work we are doing.

If it is our united goal to prepare our communities for the future, we must be clear. The costs of college – when we consider fees outside tuition, including housing – are rising. It is great students have access to a red-hot labor market, yet when students choose to forego education or training, the opportunity cost can be substantial. Ensuring all of our students have access to a postsecondary pathway, and the ability to pay for it, means thousands of dollars your community does not need to raise to find more talent. We must spread awareness about the importance of FAFSA, and work together so we use unified language and share resources. When education, community, and workforce partners collaborate toward a shared vision and with a united message, they can help remove barriers, build a robust workforce, and improve the quality of life for their regions.

RELATED ARTICLES:

2022 Talent Strong Florida Summit recap

FCAN announces 2022 Florida FAFSA Challenge winners!