By Amy Bolick, statewide programs coordinator, and Kimberly Lent, senior research associate

Completing the Free Application for Federal Student Aid (FAFSA) is the first step many students take to access federal, state, and institutional sources of financial aid.

Low-income students who complete the FAFSA may qualify for a Pell Grant of up to $5,920 a year. An estimated 60% of Florida’s high school seniors are eligible for these grants. Unfortunately, Florida students leave behind around $100 million in unclaimed Pell Grants every year because they do not complete the FAFSA.

Even students who file the FAFSA sometimes submit an incomplete or incorrect application, leaving them ineligible to receive aid. If a student submits an incomplete FAFSA, they will receive a Student Aid Report (SAR) that does not include an Expected Family Contribution, but instead has a SAR Comment Code. This code indicates the issue that needs to be resolved.

Federal Student Aid publishes a complete list of over 400 SAR Comments Codes to identify errors on the application. According to new data received by FCAN, the U.S. Department of Education (ED) provided a list of the most common mistakes students made on FAFSAs between October 1, 2016 and November 26, 2017. By understanding these errors, college access professionals can provide better FAFSA help.

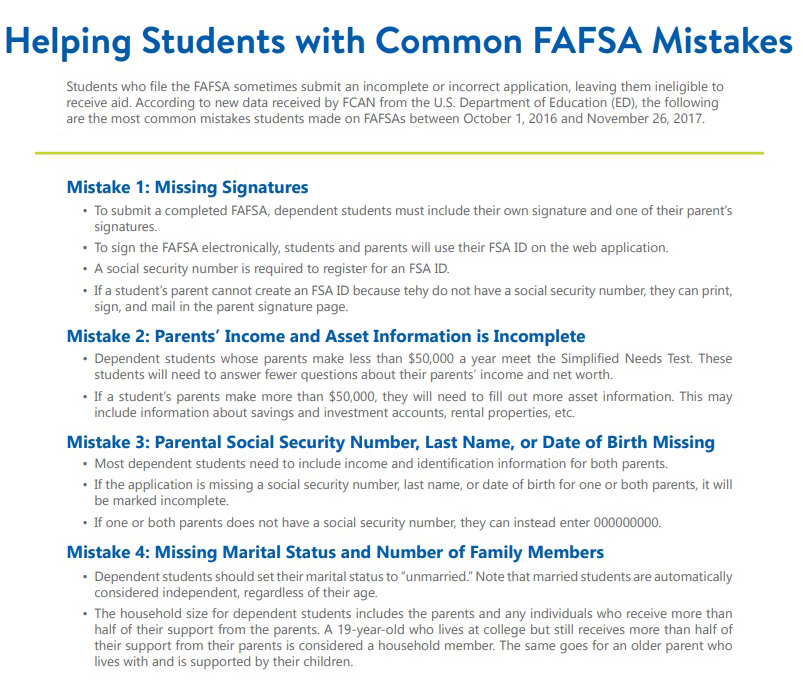

Mistake 1: Missing Signatures

To submit a completed FAFSA, dependent students must include their own signature and one of their parent’s signatures. To sign the FAFSA electronically, students and parents will use their FSA ID on the web application.

A social security number is required to register for an FSA ID. If a student’s parent does not have a social security number, they can print, sign, and mail in the parent signature page instead.

Mistake 2: Parents’ Income and Asset Information is Incomplete

Dependent students whose parents make less than $50,000 a year meet the Simplified Needs Test. These students will need to answer fewer questions about their parents’ income and net worth.

If, however, a students’ parents make more than $50,000, they will need to fill out more asset information for their parents. This may include information about savings and investment accounts, rental properties, etc.

Mistake 3: Social Security Number, Last Name, or Date of Birth Missing for One or Both Parents

Usually, dependent students who complete the FAFSA will need to include income and identification information for both parents. If the application is missing a social security number, last name, or date of birth for one or both parents, it will be marked incomplete. If one or both parents does not have a social security number, they can instead enter 000000000.

Mistake 4: Missing Marital Status and Number of Family Members

Information about the applicant’s marital status and household size helps determine a family’s financial need. Dependent students should set their marital status to “unmarried.” Note that married students are automatically considered independent, regardless of their age.

The household size for dependent students includes the parents and any individuals who receive more than half of their support from the parents. For instance, a 19-year-old who lives at college but still receives more than half of their support from their parents is considered a household member. The same goes for an older parent who lives with and is supported by their children.

Need Help Resolving These Mistakes?

If a student has a problem their FAFSA, calling the FAFSA helpline is the best way to determine the next steps to resolve the issue. Students and parents can call 1-800-4FED-AID (1-800-433-3243) from 8 AM to 11 PM Monday-Friday and from 11 AM to 5 PM Saturday and Sunday.

Get More FAFSA Help for Your Students

For the third year, Florida College Access Network (FCAN) is sponsoring the Florida FAFSA Challenge. Schools and communities who participate take on the goal of increasing FAFSA completion by at least 5% over the previous year.

Being aware of these common mistakes can help you provide FAFSA help to students who need it most. If you work in a district with access to student-level data, you can identify which students have submitted a FAFSA with errors or have started a FAFSA but not completed it. In many cases, students are unaware that their application is incorrect or incomplete.

Helping students complete or correct their applications is one of the most effective ways to boost your FAFSA completion rates quickly. By helping students complete their FAFSAs, you can help remove one more barrier standing between them and postsecondary education.

FCAN Also Provides the Following FAFSA Resources:

Track your community’s progress using our interactive FAFSA Challenge Data Dashboard.

Download FCAN’s Florida FAFSA Challenge Toolkit.

Watch FCAN’s webinar Busting the Affordability Barrier: What You Need to Know About This Year’s Florida FAFSA Challenge. Or, download the slides.